Lenders are advancing more buy to let mortgages worth more money to landlords – but the market is still running at around a third of the level of the boom years before recession hit.

Banks and building societies advanced £4.2 billion against 34,400 mortgages and remortgages in the three months to the end of September 2012.

The number of mortgages was up 2% on the 33,600 agreed in the previous quarter, while the value of the loans was 8% higher than the £3.9 billion advanced in the three months to the end of June 2012.

In 2012 to the end of September, buy to let lenders have advanced £11.8 billion – a 19% increase on the £9.9 billion borrowed by landlords in the same period 12 months ago, according to the latest market analysis by the Council of Mortgage Lenders (CML).

Nevertheless, the CML points out the market is performing at a much lower level than before the recession.

“Buy-to-let activity is recovering from a low base and remains subdued compared to the pre-credit crunch era. Buy-to-let lending this year is likely to total a little over one-third of its peak in 2007,” said the CML, the trade body for the UK’s mortgage lenders.

The figures also revealed landlords are borrowing at an average 75% loan-to-value with rent cover of 125%.

Currently, landlords have 1,444,000 mortgages worth £164.3 billion outstanding against around 3.9 million letting properties.

This is a rising trend – in the same period last year, landlords held 1,367,000 mortgages worth £156.7 billion and the figures have increased each quarter.

CML director general Paul Smee said: “Buy-to-let lending is continuing to recover, and to grow in line with expectations. As well as continuing to fund owner-occupation, lenders are contributing to the expansion of a strongly growing rental sector, helping to deliver choice and mobility for tenants.

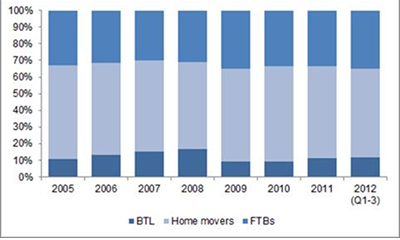

Loans for house purchase: buy-to-let, first-time buyers and home movers

Source: Council of Mortgage Lenders November 2012